Mistranslations in legal documents can lead to hefty authorized payments and other unnecessary prices that are unquantifiable. Our property planning attorneys are skilled at crafting clear, complete estate paperwork. They are educated to foresee potential areas of confusion and handle them immediately inside your will or trust. Consequently, their experience significantly minimizes the chances of future disputes or the need for judicial interpretation. If you would possibly be concerned about what occurs if a will or belief is ambiguous, it’s essential to take quick motion. Reviewing your will or trust with a fine-tooth comb may seem daunting, but we're here to information you thru each step.

Wills Vs Trusts: A Must-read Information In Your Property Plan

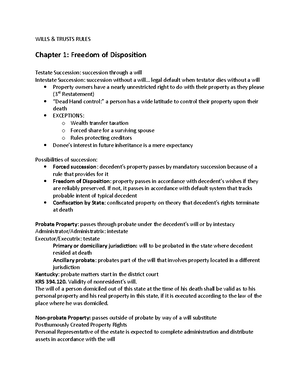

A will provides clear directions for asset distribution after demise while a trust facilitates ongoing asset management and privateness. Trusts play a vital position in property planning, offering options for asset management throughout a person’s lifetime and after dying. They offer unique advantages, including avoiding probate and addressing particular monetary needs. Navigating property planning requires a transparent understanding of the differences between trusts and wills. Every serves unique purposes and may significantly influence how belongings are managed and distributed. Trusts provide flexibility and privateness whereas permitting for detailed control over asset distribution.

- Notably, a trustee can even function a beneficiary or an executor inside a will belief.

- Trusts generally take priority over wills as a outcome of they bypass the probate course of, avoiding delays and public scrutiny.

- The “successor beneficiaries” obtain whatever trust funds stay after the primary set of beneficiaries dies.

- For occasion, proving undue influence may involve demonstrating that the decedent was manipulated by a trusted confidant or member of the family into making choices that do not reflect their true intentions.

- Working with our skilled estate planning attorneys represents an funding into the readability and safety of your estate planning documents.

Language Errors

Likewise, many organizations strive to save cash by hiring college college students to do the translation. They should have a solid background in regulation to render the translations accurately. Authorized translation is demanding as a outcome of the translator must be well-versed in the supply and target languages’ legal guidelines. The purpose of a session is to discover out whether or not our agency is a good fit for your legal needs. Although we regularly discuss expected results and prices, our attorneys do not give authorized recommendation unless and till you choose to retain us.

What’s The Difference Between A Belief And A Will? A Complete Guide For Estate Planning

People who set compelling targets often experience increased satisfaction and sense of objective. Incorporating visual reminders and accountability methods, corresponding to sharing objectives with others, can additional reinforce commitment. legal translations of willpower into goal-setting allows individuals to navigate obstacles and maintain momentum toward achieving their desired outcomes.

Will Vs Trust: Key Differences

Shield what’s important for the people who matter and guarantee your final wishes are revered. Our estate planning consultants have over 50 years’ experience in later life planning and will help you at each step of the greatest way. A will trust provides each a will and safety, guaranteeing the authorized proprietor maintains control over their belief assets and that they're correctly belongings distributed. Notably, a trustee also can function a beneficiary or an executor inside a will belief. This signifies that the identical individual could probably be managing the belongings, benefiting from them, and executing the will.

- A belief is a authorized entity that manages property during one’s lifetime and after demise, permitting for more management and privateness.

- To resolve ambiguities and defend the integrity of the testator’s needs, extrinsic proof is usually used to clarify the language of a will.

- The judicial treatments for what happens if a will or trust is ambiguous are various, however they sometimes involve looking for the court’s interpretation or instruction.

- Wills take impact solely after demise, with asset administration obligations falling on the executor.

- Whereas trusts provide flexibility and privateness, permitting for asset administration throughout life and after death, wills offer a straightforward approach to outlining last needs.

- Trusts and wills are both estate planning tools, but they serve totally different functions.

Probate

Moreover, a will can nominate guardians for minor youngsters, guaranteeing their care aligns with the deceased’s wishes. A belief is a authorized association that permits for asset management and distribution whereas avoiding probate. Wills are less complicated paperwork outlining how assets are distributed after dying and require probate. Trusts present flexibility and can include specific conditions, while wills are simple for expressing needs and appointing guardians for minors. Understanding the distinction between a will and a belief is crucial for efficient property planning.

Contested Will? Contact Our California Probate Litigation Legal Professionals Now

The “successor beneficiaries” obtain whatever belief funds stay after the primary set of beneficiaries dies. A trust takes effect as quickly as you create it and may distribute property before dying, at demise, or afterward. A living will, or superior directive, pertains to medical remedy preferences and end-of-life care selections. A will could be the least expensive and best choice for small estates with simply transferred belongings and simple bequests. Trusts, then again, provide ongoing management of assets throughout a person’s life and after their passing. This flexibility allows individuals to set particular phrases for distribution, protecting property from probate and potential mismanagement. When it involves estate planning, understanding the difference between wills vs trusts is essential. Both serve unique purposes in managing one’s belongings after death, but they operate in distinct methods. A will outlines how a person’s belongings should be distributed, while a trust can provide ongoing administration of those assets during and after a person’s lifetime. While trusts present flexibility and privateness, permitting for asset administration throughout life and after dying, wills supply a straightforward method to outlining last needs.

Is It Better To Set Up A Lifetime Belief Or A Will Trust?

Wills require probate, a legal course of that validates the will and oversees asset distribution, which could be time-consuming and public. In contrast, trusts bypass probate, allowing for instant asset administration and distribution without court docket intervention. Trusts could involve complicated legal requirements, necessitating precise drafting to make sure validity and compliance.